- Our services

- Optimisation of premiums

- Bonus

Bonus

A traditional bonus is heavily taxed and subject to very high social security contributions (NSSO).

By converting the bonus into warrants, the employee and employer are exempt from social security contributions, and the employee's net can be increased by up to 45% (warrants) or up to 90% (long-term options) via a partial or total retrocession of the employer's social security contributions to the employee.

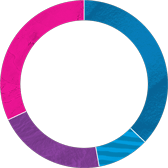

Cash bonus

Short term warrants

Long-term options

- net

- Taxes

- NSSO Employee

- NSSO Employer

- Loss of time value

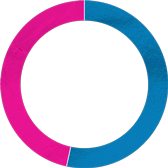

Warrants plan (short term)

- NO employer/employee social security contributions

- Blocking period: 8 hours

- Increase in net remuneration of around 45% compared with the classic cash bonus

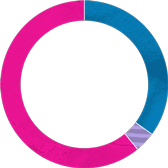

Long-term options plan

- NO employer/employee social security contributions

- Advantageous flat-rate tax

- Blocking period: 12 months

- Increase in net remuneration of around 90% compared with the classic cash bonus